Power struggle: PG&E, state officials work on Diablo's future while community benefits of offshore wind energy are up in the air

By Peter Johnson and Shwetha Sundarrajan

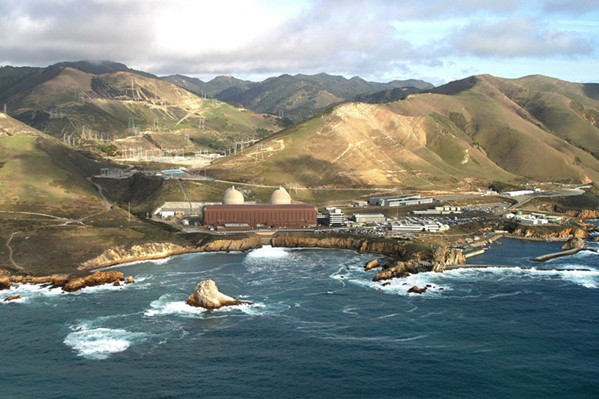

Cover Images: File Photo, Adobe Stock

UP IN THE AIR A new era for energy production is on the Central Coast horizon with offshore wind leases taking shape, while PG&E and the state outline possibilities for Diablo Canyon.

[{

"name": "Ad - Medium Rectangle CC01 - 300x250",

"id": "AdMediumRectangleCC01300x250",

"class": "inlineCenter",

"insertPoint": "8",

"component": "2963441",

"requiredCountToDisplay": "12"

},{

"name": "Ad - Medium Rectangle LC01 - 300x250",

"id": "AdMediumRectangleCC01300x250",

"class": "inlineCenter",

"insertPoint": "18",

"component": "2963441",

"requiredCountToDisplay": "22"

},{

"name": "Ad - Medium Rectangle LC09 - 300x250",

"id": "AdMediumRectangleLC09300x250",

"class": "inlineCenter",

"insertPoint": "28",

"component": "3252660",

"requiredCountToDisplay": "32"

}]

The Central Coast is on the cusp of big changes regarding green energy production, but the transition will take time. Currently, state, local, and PG&E officials are discussing how to keep energy flowing from Diablo Canyon Power Plant. Faced with the challenge of energy shortfalls amid climate change, state lawmakers released funding to keep Diablo open, though it was set to be decommissioned soon. Assistant Editor Peter Johnson has the details about Diablo's future. Meanwhile, offshore wind energy lease sales wrapped up on Dec. 6, leaving questions in their wake about impacts on Morro Bay stakeholders, including local fishermen. Staff Writer Shwetha Sundarrajan spoke with energy groups and fishermen for the story.

PG&E, state agencies look ahead to busy 2023 for determining future of Diablo Canyon Power Plant

The Diablo Canyon Decommissioning Engagement Panel's final meeting of 2022 focused on a topic that contradicts its title: the recent push to possibly extend operations at the Avila Beach-based nuclear power plant.

PG&E and state officials joined the local citizen panel on Dec. 14 to provide an update on what's transpired since the passage of Senate Bill 846—which unlocked $1.4 billion in state funding to help PG&E try to relicense Diablo and operate it through 2030—and what's in store next year.

The bottom line, according to the officials, is that the path ahead for Diablo is complex and compressed, with many key milestones and decisions taking place over the next 12 to 24 months.

Tom Jones, a senior director with PG&E, told the panel that the company continues to prepare for two outcomes: one in which Diablo is decommissioned as planned in 2024 and 2025, and one in which it operates at least five more years under new licenses.

"We'll know one of them to be true two years from now," Jones said. "We're maintaining both functions because while it's been portrayed at times that SB 846 is a done deal and the plant's going to run, we can't certainly take for granted that's going to occur."

Since the legislation passed in September, PG&E applied for and received a $1.1 billion grant from the U.S. Department of Energy, which will help backfill the state subsidies, and began engaging with the Nuclear Regulatory Commission (NRC) on a path forward to relicense Diablo's two reactors.

The plant's current licenses are set to expire in 2024 and 2025, as PG&E withdrew its renewal applications in 2018 when it decided instead to close the plant. Now, the company is hoping the NRC will reconsider that original application—in a condensed timeframe.

"In short, we've asked for two things [of the NRC]," Jones said. "To reinstate our previous [relicensing] application we submitted in 2009. And we've asked for a timeliness exemption."

When pressed by decommissioning panel member Kara Woodruff about the length of the license that PG&E seeks, the utility confirmed that it will be applying for full 20-year licenses. But the recent state law only authorizes a five-year extension for Diablo.

"We would be submitting a 20-year one, but we have to also meet the state of California's regulations, and that's for five years," said Maureen Zawalick, vice president of decommissioning and technical services at PG&E. "The state holds the keys to Diablo Canyon."

To prepare for the potential extension, Jones and Zawalick said that PG&E is using the first $600 million of state funding from SB 846 to purchase more uranium and dry cask storage—items with "long lead times" that are crucial to Diablo's operation.

"The window was literally about to close. We didn't have fuel beyond its current license," Jones said.

PG&E has also assembled a 40-person license renewal team and plans to work with the California Public Utilities Commission next year on a new employee retention program for plant workers, according to Jones.

As PG&E gears up for 2023, so does the Diablo Canyon Independent Safety Committee, a three-person board tasked with reviewing and making recommendations on plant safety.

Longtime committee member Robert Budnitz spoke to the decommissioning panel about its role overseeing seismic safety and maintenance at the plant. Budnitz spoke highly of a "comprehensive" seismic study completed in 2015 for Diablo and noted that SB 846 requires an updated seismic analysis.

"I've been on this committee for 15 years and it's met seismic standards all the way along. The question is what is it today?" Budnitz said. "We are initiating a review to see whether anything is different or changed that would make us revisit that conclusion seven years ago and come to some different conclusion. We're right in the middle of that."

He added that PG&E did defer some capital projects at the plant in light of its expected closure in 2025—though none that "compromised safety." Now that the plant is seeking relicensing, Budnitz said PG&E has to commission a study to determine the plant's maintenance needs going forward, which the committee will review and offer input on.

"We're going to know a lot more in a few months," Budnitz said.

A high-level state official also spoke about the work ahead in 2023.

Siva Gunda, vice chair of the California Energy Commission, told the panel that multiple state departments are tasked with nearly 50 action items related to SB 846 and Diablo Canyon. At the core of their work is analyzing the state's near- and long-term power needs and studying whether Diablo Canyon is a needed and cost-effective source of power between 2025 and 2030.

Gunda explained that climate change has had a "compounding effect" on the state's ability to properly plan for and maintain grid reliability. Brownouts and close calls during recent heat waves compelled the discussion about keeping Diablo Canyon, as the state's struggled to bring enough renewable energy sources online to bolster the grid.

"What's happening recently is kind of the struggle with climate change," Gunda said. "The extreme weather we're watching right now is almost impossible to capture in the [power] procurement we do. What happened earlier this year [during the Labor Day heat wave] was really ... an illustration of how much more resources we need in typically covering reliability."

The panel's Dec. 14 meeting did not allow for public comment, which drew some criticism. Citizens were asked instead to submit their questions and comments on an online portal before the meeting.

Panel member Bill Almas spoke to the need to include the public more in the Diablo Canyon extension process.

"Many of those people have questions. We're not actually answering many of those questions directly," Almas said. "Looking at the amounts of budget that are provided to the regulatory agencies and the money provided to PG&E for purposes of this extension, there should be a beef-up in staff at these agencies. There needs to be an attempt to answer, even if it's a courtesy answer, everybody's questions concerning this extension." Δ

Assistant Editor Peter Johnson can be reached at [email protected].

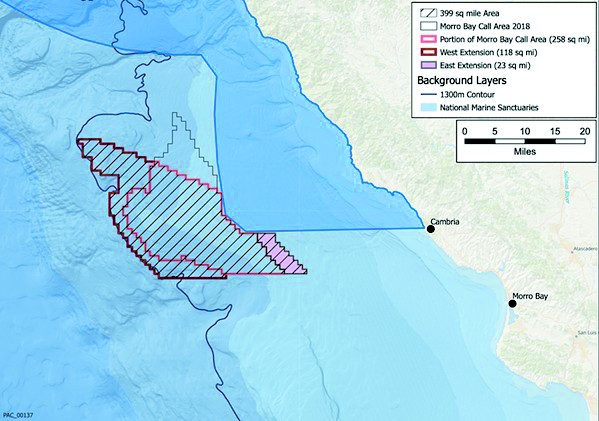

As the offshore wind energy lease sale wraps up, the promised local community benefits are hazy

As three energy companies continue negotiating their recently won offshore wind leases with the U.S. government, Morro Bay residents face an uncertain future. And some stakeholders feel left out of the process.

The Morro Bay Commercial Fishermen's Organization has felt disenfranchised by the Bureau of Ocean Management (BOEM) throughout the entire lease auction process.

"We had our voices heard, they just don't give a damn," Alan Alward, secretary of the Morro Bay Commercial Fishermen's Organization said.

While he does understand BOEM's position to wrap up the lease sale auction as fast as possible, Alward said fishermen are the one group that's going to be impacted by the project.

"The fish [are] out there where you're putting these windmills, and we're gonna be affected by all the increased port traffic and the cables coming ashore," Alward said.

To alleviate the effects that the offshore wind energy project would have on the community and specific community groups such as the fisherman's organization, BOEM offered companies three types of bidding credits that would be put toward helping the local community. But Alward felt that the way BOEM approached the bidding credits disenfranchised the fishing community.

"BOEM would've just liked to have ignored [us] and they kept telling us that they had no ability to constrain the companies to make them deal with the fishermen," Alward said.

Bidders seeking to develop the local workforce would receive a 20 percent credit, while community benefit agreements targeting affected communities would only receive a 5 percent credit. Dissatisfied by the bidding credits offered to them by BOEM, the commercial fishermen's organization drafted an agreement for potential lease developers. That agreement outlined several benefits the organization would like to see, specifically the Fishing Community Benefit fund. According to Alward, the fund would have companies chip in 5 percent of their operating fees to preserve the fishing industry so it doesn't disappear over the years due to the offshore wind project.

However, none of the companies that won the lease sale auctions have signed an agreement with the fishermen's association yet.

The community benefit agreements were part of the lease sale auctions, which wrapped up on Dec. 6. Three companies secured a bid for the lease areas 34 miles off the coast of Morro Bay, totaling $425.6 million. The winning companies are Equinor Wind US LLC, Central California Offshore Wind LLC, and Invenergy California Offshore Wind LLC.

While the provisional bidding winners may be newcomers to the Central Coast, the companies have complicated pasts.

Chicago-based energy company Invenergy has had legal issues regarding several of its past projects, such as a New England power plant that was hit with two lawsuits in 2018. The lawsuits alleged that Invenergy was trying to shift $100 million in costs onto New England electricity customers. The company argued that the cost for building power lines to provide connection to the electricity grid was the responsibility of the ratepayers.

While Central California Offshore Wind LLC has avoided lawsuits and controversy in its short existence, its parent companies, EDP Renewables (EDPR) and ENGIE, have not.

According to renewable energy newsource Recharge, EDP Renewables landed in hot water in 2020 after company executives were found in the middle of a corruption scandal—alleged bribery involving Portugal's former economy minister Manuel Pinho.

Last year, French utility company ENGIE entered a 15-year supply deal for liquified natural gas in Texas, despite rejecting a similar deal in 2020. ENGIE's decision to sign the contract drew the ire of many climate activists, who lambasted the company for false promises to go carbon neutral, according to Politico.

Norwegian-based company Equinor was formerly known as Statoil, the fifth largest producer of oil and gas in the Gulf of Mexico, according to the company's website.

In 2018, the energy company was accused of "greenwashing" after rebranding as Equinor in an attempt to reflect its transition away from oil and gas. According to environmental organization ClientEarth, Equinor approved four new oil and gas projects in 2020, and sold off parts of its offshore wind power assets worth more than $1 billion.

Equinor told New Times that it was already working with local organizations to implement community benefits as a result of winning its offshore wind lease bid near Morro Bay.

"Equinor is committed to taking an inclusive approach to community benefits agreements, prioritizing environmental justice, tribal communities, and historically underserved communities," the company wrote in a statement.

Since the lease areas would be in Northern Chumash territory, Northern Chumash tribal council member Violet Walker said she visited Equinor's wind farms in Denmark in September to see what they were all about.

"They may be the best qualified company to do what we need to do here. But we haven't actually had a sit-down meeting with them," Walker said, adding that it was too soon to know who the companies' tribal representative would be.

It might be too early in the process to determine what exactly the community benefits from the lease agreements might be, said Adam Stern, executive director of Offshore Wind California, a coalition of industry members aimed at building public support for offshore wind power in the state. While the bidding process is over, the companies that won don't necessarily hold the leases yet.

Stern said that they still have to go through an evaluation process with the Justice Department to make sure that there aren't any antitrust violations. Once that's finished, Stern said, it could take until spring for the companies to actually have the leases in hand. Then, of course, there's the permitting process.

"It needs to be done responsibly, and take into account the interests and concerns of stakeholders, whether they be community members, environmentalists, fishermen," Stern said. "At a time when we urgently need new clean energy sources to deal with climate change, I believe we can both develop the resource and protect coastal and marine resources safely." Δ

Reach Staff Writer Shwetha Sundarrajan at [email protected].

Latest in News

Readers also liked…

-

Coast Unified teachers upset over new position's salary and qualifications

Oct 20, 2022 -

SLO police identify alleged driver who hit and killed couple

Dec 22, 2022 -

When the levee breaks: Oceano residents, county officials walk a tightrope of regulations to manage Arroyo Grande Creek, which some say led to the levee's failure in January

May 18, 2023